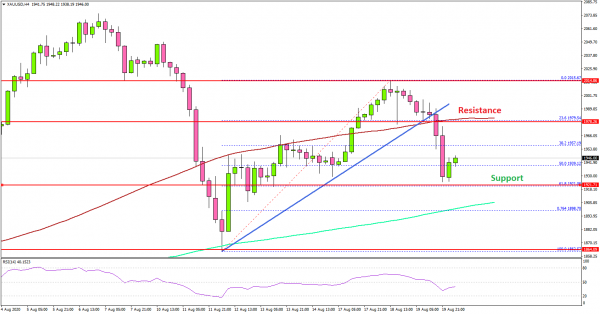

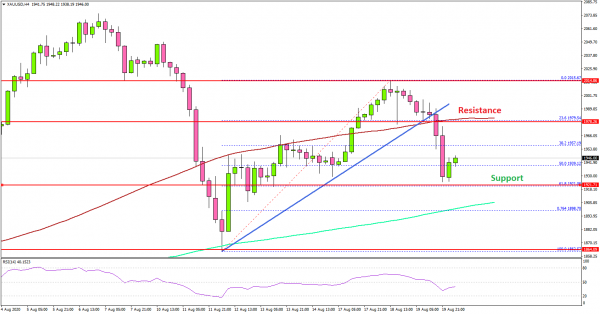

After declining sharply to $1,863, gold price started an upside correction against the US Dollar. The price recovered nicely above $1,900 and $1,950, but it struggled to gain strength above the $2,000 level.

The 4-hours chart of XAU/USD indicates that the price traded as high as $2,015 before starting a fresh decrease. There was a break below the $2,000 support level and the 100 simple moving average (red, 4-hours).

Moreover, there was a break below a major bullish trend line at $1,980 on the same chart. The price traded below the 50% Fib retracement level of the recent increase from the $1,862 low to $2,015 high.

If the price continues to move down, the price might decline towards the $1,920 support. It is close to the 61.8% Fib retracement level of the recent increase from the $1,862 low to $2,015 high.

Any further losses could lead the price towards the $1,900 support or the 200 simple moving average (green, 4-hours). Conversely, the price could bounce back from $1,920 or $1,900.

On the upside, the price is facing hurdles near $1,980 and $2,000. A successful daily close above $2,000 is needed for a sustained upward move. The next key resistance is near $2,025 and $2,032.

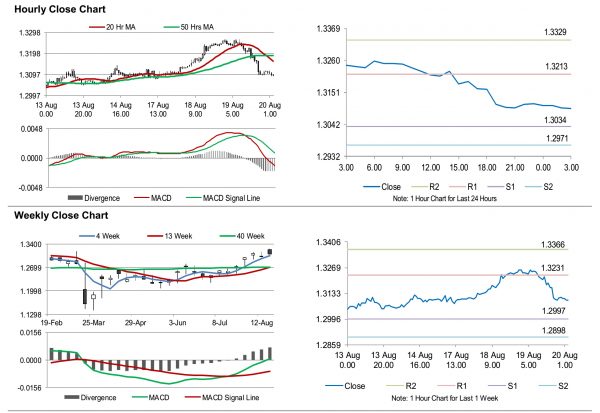

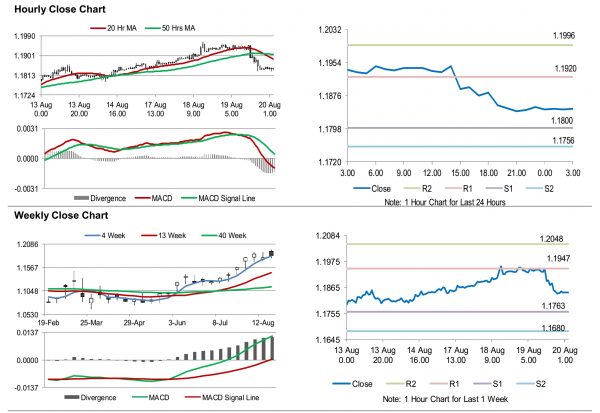

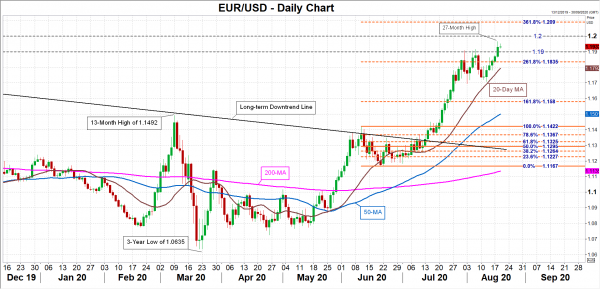

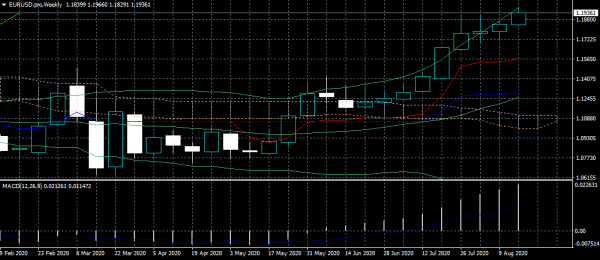

Looking at EUR/USD and GBP/USD, both started a short-term downside correction after trading to a new multi-week high.

Economic Releases to Watch Today

- US Initial Jobless Claims – Forecast 925K, versus 963K previous.